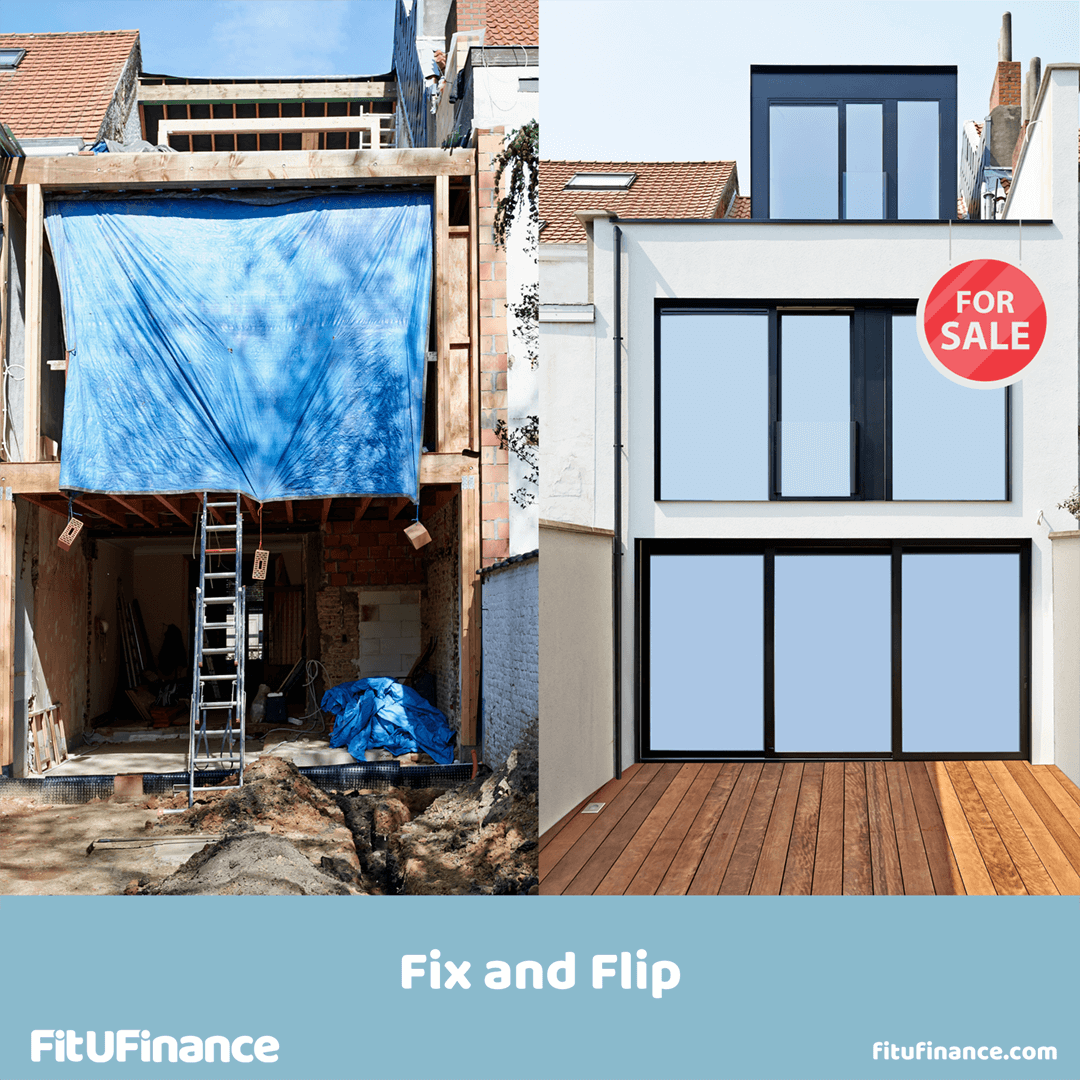

FIX AND FLIP FINANCE OPTIONS

Fix and Flip Financing:

What You Need to Know Before You Start

Fix-and-flip properties can be highly profitable but only if your financing is on point. Without a solid financial plan, you could face unpleasant surprises that derail your project.

Start with Clear Goals and a Budget

Before diving in, define your objectives:

- Budget: Know exactly how much you’re willing to spend each month.

- Timeline: Decide how long you’ll hold the property.

- Expected Return: Set realistic profit expectations.

Of course, you’ve likely done your due diligence on the property’s structure and estimated renovation costs. But successful flippers also plan for cash flow and financing from day one.

Why Many Flippers Fail

A common mistake among new investors is failing to answer basic questions about their plan or not having the paperwork ready for a loan application. Preparation is key.

Financing Options for Flippers

Whether you’re new to flipping or an experienced investor, there are several financing options available:

- Specialized Lenders: Some companies finance up to 85% of the purchase price and 100% of renovation costs. Look for lenders familiar with the BRRRR strategy (Buy, Renovate, Rent, Refinance, Repeat), as they often favor these projects.

- Asset-Based Loans: These loans are based on the property’s value rather than your credit score. This is ideal for borrowers who’ve faced foreclosure or short sales, as the property serves as collateral. Both beginners and seasoned investors use these loans to free up liquidity or scale their business.

These loans typically apply to single-family homes, multi-family properties, and mixed-use buildings which are all attractive to lenders.

Your Main Financing Options

- Conventional Bank Loans

- Require at least two years of successful renovation history.

- Can offer lower interest rates (around 3% – 4%).

- Require a strong credit score, an official business, and a proven track record.

- Downside: Approval can take several months.

- Fix-and-Flip Loans

- Calculated based on:

- Current property value

- Planned renovations

- Estimated After Repair Value (ARV)

- Hard Money Loans: Popular among investors because:

- Approval focuses on the property and deal, not your credit score.

- No minimum renovation requirement.

- You can choose any licensed contractor.

- Fast closing: Often within days

Why Speed Matters

In the fix-and-flip world, timing is everything. Conventional mortgages can take 60 days or more to close, while hard money lenders can fund deals in just a few days, giving you a competitive edge.

Need Help Finding the Right Lender?

We specialize in real estate lending and can help you source the best financing option for your project. Whether you’re flipping your first property or scaling your investment business, we’ll guide you every step of the way.